The Claycord “Sound Off” is a new feature on Claycord.com.

It’s similar to “letters to the editor,” so if you have something you’d like to sound off about, send it to us at news@claycord.com, and we’ll review and possibly post.

It can be something that’s on your mind, something that needs to be fixed around the city/county, something that bothers you, etc. Like we said, it’s basically like “letters to the editor,” only more local.

Please try to keep it local, respectful and interesting. Please include a photo if possible (not required).

Today’s submission is from Anonymous in Concord.

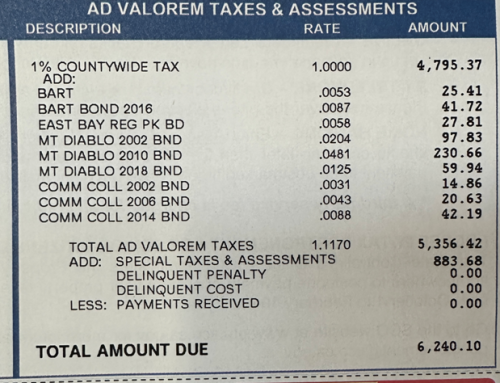

I was wondering if you could post and remind people of all the tax bonds they have voted in over the years that impact our property taxes in Claycord .

The Mt Diablo Unified School District has three bonds on our property tax bill from 2002, 2010, and 2018. Three bonds! I’m sure they will ask for more money in the coming years. Taxpayers forget what they voted for and keep adding to the bonds. Also the community colleges have 3 bonds were still paying for! Yet every few years they ask for more money.

I feel taxpayers should be reminded of how much they have voted for in the past that affects their wallet. With inflation and gas prices, stop voting in more bonds. Make the schools and BART be fiscally responsible for themselves.

-Anonymous in Concord

Just sickening! Glad i never voted!

I agree! People vote these Bond Measure in without realizing they haven’t paid off the old ones yet. They don’t have the tax bill in front of them to remind them of what it’s costing them. When the tax bill comes, it’s “read it and weep.” By then it’s too late to do anything about it. It’s like taking out a new loan when you haven’t paid off the old one You wouldn’t do that in your personal finances, so why should BART, the Community College District, MDUSD, or any other organization seeking funding be allowed to.

And, this doesn’t just affect property owners, by the way. Wonder why your landlord keeps raising your rent? To pay for all those bond measures you voted for. If you want to get control of your costs to rent, stop voting for bond measures which your landlord is then forced to pass on to you as a rent increase.

Unfortunately, so much of our economic system is based on “growth” which doesn’t necessarily mean “better.” We need a way to decide whether quality of life issues are more important than “growth.” BART is guilty of subscribing to the “growth” model. To them, “Bigger is better.”

Yes, property taxes affect renters too. Problem is, unlike homeowners, renters don’t see a property tax bill every 6 months. So they don’t get a reminder of how many bond measures we’re already paying for. Or that they add up to 30% of the total property tax bill. So it is safe to assume that homeowners have a much better idea of the financial impact of yet another parcel tax and yet another bond measure. While renters may see it as a “rich man’s problem”.

Thanks for the reminder / post…. speaks volumes – and we need reminders before each election…..

Bonds=taxes

Proof right here, no matter what anyone says. Say it with me now:

Bonds=taxes

Period

Bonds=taxes

And we never see anything good happen because of them.

Let me look at my tax bill

Mt D Mello Roos $ 67.00

CC- FED STRMWTR Fee $ 51.00

MOSQUITO VECTOR $8.52

EMERGENCY MED B $ 10.00

SFBRA PCL TAX $ 12.00

EASTBAY TRAILSS LLD $ 5.44

BART BOND 2016 $ 153.39

EAST BAY REG PK BD $102.25

MT DIABLO 2002 BND $359.65

MT DIABLO 2010 BND $848.00

MT DIABLO 2018 BND $220.00

COMM COLL 2002 BND $ 54.54

COMM COLL 2006 BND $ 71.80

COMM COLL 2114 BND $ 155.10

Grand Total= $ 2,118.69

What a great state to live in. Property owners should know better. Renters wonder why landlords raise the rent.

Lou

OMG $1427.65 for MDUSD alone. That’s insane. Almost spit up my coffee adding that up. And what exactly is done with that money? Certainly doesn’t go towards quality of education.

So grateful I no longer live in Concord or the bay area for that matter. My property tax bill for my house (1400sq ft house on a 6800 sq ft lot) is $1950 a year all inclusive.

Thanks for the post. I never vote for more taxes!

If you think that is bad, look at the “Special Taxes & Assessments” section (Res Sewer) ours is over $700.00.

If you’re a senior, all taxes pertaining to schools should automatically be deleted.

How about people just pay for their own kids??? And if you can not pay for your own kids, you should not be allowed to have them!

The mismanagement and corrupt practices by city, county and state politicians in California is equivalent to treason. ALWAYS VOTE NO when they ask for more money, the middle class is always going to get the short straw. They need to learn how to manage the MORE THAN SUFFICIENT amount of money they take from us already.

Don’t forget the schools. That mismanagement is criminal

There’s little difference between a common career criminal and the majority of California politicians. Compared to the common criminal, the politicians are more adept con artists, they are more skillful liars, and they dress better.

This last election I made sure I voted against anything that would raise my taxes. Sorry folks but the citizens are not an ATM that you can get money from anytime you want. Put down that ganja pipe and face reality. Take a look at your own bills and stuff. Take a look at gas and food prices. Get the picture? Time are bad and you most likely aren’t going to win the lottery tomorrow.

Our governor plans to pay anyone related to a slave $230,000.00. Fortunately only one time though. Unless that changes. So that may be added to your property tax also. Do you have any slaves you are related to? I figure a family of five could haul in a million bucks maybe more.. How did they get so stupid?

Of course it is not a one-time thing. These people are SO entitled. It is never enough and they must blame everyone but themselves.

Since 1989 MDUSD has levied over ONE BILLION DOLLARS (principal) in new school “building improvement” bonds. New residents have no idea, and new parents think… “it’s for the kids sake,” so they just keep voting Yes. In between new bonds, they “refinance” existing bonds to “lower interest rates” but at the same time, they drag the repayment out for more years. There are bonds on the books now that are not due to finish being paid off until 2050… Yep!! In the meantime will another BILLION be needed just to keep up with skipped maintenance? Yes. We look back and see records that said they were spending $xxx for new roof at XYZ… but in 7-8 years thay are doing it again, and tell us that as it turned out, they had to skip XYZ in order to put in a new pool and a modern student quad in at WXY, and yada yada yada. Our schools are being run by Union controlled politicians and primadonnas.

Just because you raised a couple kids or could teach English, or used to do building maintenance for the district, and are all in for the Union Labor commitments doesn’t automatically qualify you to handle billions of dollars.

WHY DID MDUSD PAY A SEENO BUDDY IN PITTSBURG A MILLION DOLLARS PER ACRE FOR A DUMPING GROUND SINK-HOLE OF 11 ACRES IN BAY POINT, WHEN, 1N 2010, ACREAGE WAS GOING FOR LESS THAN HALF THAT AMOUNT? HMMM? WHY IS THAT ELEVEN ACRES STILL JUST SITTING THERE– EMPTY? WHY ARE WE STILL PAYING FOR IT?

As far as I can count, it’s almost a billion in principal, not over a billion. 90 million of Mello-Roos in 1989, 250 million in 2002, 348 million in 2010 and 150 million in 2018. Plus about 8 million from Prop 39. A total of 850 million or thereabouts.

Despite refinancing, the real tax rates are still higher than the highest projected rates: we were promised max combined rate of 2002 and 2010 measures to be no more than $0.05948 per $100. In reality it’s $0.0685 per $100. And you’re right that we’ll be paying on these bonds for the next 30-40 years. And you’re also right that MDUSD will be back for more.

You seem to have correct figures there, TASHAJ. I may have been counting some refi’s in 2004 and ?’06 was it? I forget ~~ with “cash outs” that put the figures higher– in my mind, at least. Can anyone explain how long the Mello Roos will be dipping into our wallets.

Oh, BTW. If any of you are 65+ you can file to have Mello Roos and one of the Park District bonds deleted from your property tax.

As for the Sewer/Stormwater OUTRAGEOUS amounts the city has raised that tax, which is based on how much water goes through the sewer to the treatment plant … A one-person-senior household has to pay the same as the house next door with 6 or 7 people sending water down the drain. You know there’s something grossly wrong with that.

I genuinely have little stakein this conversation, my kids are in a different district and I don’t own property. However, I found this link from the county specifically about tax rates and adjustments reflecting the bond measures. It also list when bond measures end.

https://www.contracosta.ca.gov/6572/Tax-Rates

Learn to Vote No…Simple

The solution is to start treating these agencies like any other beggar with their hand out that you might meet up with on the street … just say “No.”

Take a good look at the property tax bill: Actual property tax is about 1/3. Bonds and special assessments together is the other 2/3s. Seniors can have local school assessments, but not school bonds, removed from their tax bill. But only if you go down in person and prove you are a senior.

I go to Martinez each time to pay the bill and each time I ask the same question: Is there anything that I can have removed? Most of the time it’s NO. One time I had to call and was told, yes, I could have about $0.50 of one particular assessment reduced. The phone call cost me more.

To provide complete information, here is a list of projects MDUSD is spending that bond money on, by site (just so people are even marginally informed on what the money is for): https://www.mdusd.org/pf4/cms2/view_page?d=x&group_id=1542443157641&vdid=ix4f99a218vnbez

Bonds are for capital projects. Schools cannot be ‘fiscally responsible’ for themselves because they are not a profit-generating entity that has income coming in by selling goods or services. The only money they have is from the public.

thank you for the link to the “plan” list JANE GREY; I encourage everyone to go to that link. Pick a school. click on the “SOLAR PERFORMANCE” and see how it is doing. WE PAID Sun Power up front for guaranteed performance, and PAID for an online system to prove our Warranties. And we will continue to pay for as long as we live in the district. Not to start a disagreement JANE GREY, but each school IS responsible for every penny any authorized organization on campus collects for any purpose. AND we DO elect a School Board, and that School Board has a Legal Fiduciary Duty owed to us on every dollar they approve spending from our taxes. What we do not have is anyone who cares AND is “financially able” enough to take them on in court.

Except the public just voted to keep the corrupt schoolboard the same. Some people are just too stupid to be alive.

Schools can sure as hell be “fiscally responsible “; they just need to spend money in a prudent manner…..regardless of where the money comes from. Throwing it away on useless items demonstrates fiscal IRRESPONSIBILITY.

de javu all over again. Thanks for a quick glimpse of the shadow of the old “RANTS” column Mr. Mayor and Team. I’m all better now. 🤗