In a survey conducted by CardRates.com, a ‘stress tipping point’ has emerged as a key concern among Americans grappling with personal financial pressures. Moreover, the opportunity to sell gold jewellery for cash Adelaide offers a positive avenue for individuals to address their financial needs proactively.

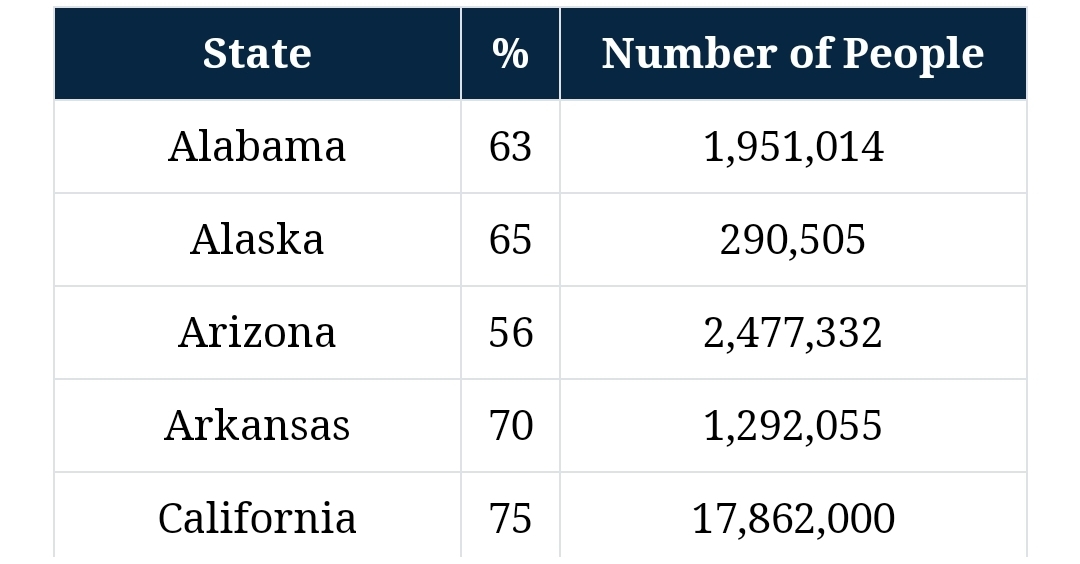

The survey engaged with 3,000 respondents who are managing ongoing financial commitments. It uncovered that 3-in-4 Californians (75%) are on edge about nearing a ‘stress tipping point,’ a state where the burden of their financial responsibilities surpasses their ability to cope effectively, potentially causing severe psychological distress. This equates to a staggering 17,862,000 adults in the Golden State. This compares to a national average of 65%. To lower their stress levels, playing games such as KQXS might help.

Reinforcing these concerns, recent figures from the Federal Reserve Bank of New York indicate a sharp rise in total financial obligations, which climbed to $17.06 trillion in 2023 – a 4.15% increase from the previous year, signaling a trend that could accelerate the approach towards this ‘stress tipping point.’

The phenomenon appears to be geographically uneven, with Vermonters reporting the highest instances of financial strain that could lead to such a tipping point. A staggering 83% feel their circumstances are becoming unmanageable – this represents approximately 328,000 Vermonters. Conversely, Idahoans have reported less susceptibility to this tipping point, though the 25% who do still represent a considerable portion of the community – around 289,000 people.

CardRates.com has created an infographic that illustrates the varying degrees of financial strain and the proximity to the ‘stress tipping point’ across different states.

The survey also probed into the wider social effects of approaching a ‘stress tipping point,’ revealing that personal relationships are becoming collateral damage to financial unease. Fifty-nine percent of respondents see their relationships being affected, while two-thirds observe a similar impact on their friends and family.

On a scale of 1 to 10, the average confidence level in managing financial stress hovers at a concerning 6/10, hinting at the uncertainty many feel about their ability to stave off the ‘stress tipping point.’ Daily worries about financial matters are a reality for 17% of those surveyed, further indicating the pervasive nature of this issue.

In the face of these challenges, a proactive stance is still prevalent, with an encouraging 82% of participants actively seeking out solutions to circumvent reaching their ‘stress tipping point.’

“As our latest survey reveals, this ‘stress tipping point’ represents more than just a fiscal benchmark; it’s a critical indicator of societal well-being. Our findings call for a collective effort to address and mitigate the factors contributing to this widespread concern,” says Ashley Fricker, Senior Editor with CardRates.com.

.

A by-product of CA’s cost of living, taxes, and fees plus Bidenomics on the entire nation.

.

Let’s add the general effect of people trying to keep up with the Joneses and the “gotta have it” culture, right? LIke those dumb Stanley drink cups. It’s madness.

.

Or gold sneakers that you can’t even get until June or July

Explain Bidenomics.

Jessica, Biden’s Green New Deal. Biden’s decision to cancel the Keystone XL pipeline and energy development has led to higher energy prices, and everything we buy as consumers has been affected. Production of goods takes energy, factories need it, the shipping industry needs it, warehouse storage facilities need it, and the store where we buy our goods need it. The federal government has created so many new laws that state energy commissions such as California’s PUC are forced to approve price increases in our gas and electric companies because of the new technology they have to develop in order to keep up. The reason I know this is from watching utility representatives from five different states testify before the House Committee on Energy and Commerce, on C-SPAN.

This is a short summary, there’s a lot more to it, but I don’t have the time. Hopefully, you get the idea.

Bidenomics can best be illustrated by an inverted pyramid. Basically playing a game of Jenga with the economy.

Get a grip you people work harder get a second job if necessary.My wife and I both worked.We didn’t live beyond our means.Worked hard payed for our child care without help from the system.People want to much for free now.Weak weak weak!

When was the last time you applied or interviewed for a job? Times have changed. You wouldn’t believe the work agreements companies want you to sign. They want you to be a serf. Some still require the clot shot.

People started using their credit card to stay afloat when the pandemic began. Remember it was only supposed to be a couple months and then over. If the credit card companies collapse they deserve it for supporting the politics of the elite and their puppet in the White House who has only made inflation worse.

Some of us have done the research in all areas to see what’s really happening. The rest are just very poorly informed.

May you live in interesting times (too say the least).

My most recent application for my new job was about 4 months ago. No serf contract for me. WFH fully while making very good money. I make the good money because I have worked hard since I got out of high school, finally got a college degree and put my nose to ground to get stuff done.

Times have not change when it comes to employers … but I will say I know of several employees (co-workers) who want the moon and beyond. They would rather work on the rainbow and dei nonesense than what they were hired to do and then cry when they are not allowed.

Finances can be tough … I drive a 10 year old vehicle with close to 200K. My wife has the newer vehicle, still 6 years old with 70K miles. We travel on money we have in the bank, and not on our credit card. We do not eat out, cause we want to do other things.

Maybe your research should include how many of these credit card debts are because people are living ABOVE their means. You can not drive a Rolls Royce if you have a Yugo budget.

You are sounding squared away, good for you.

Wise man told me 40 some years ago,

“you put 6 months gross salary in the bank and you don’t touch it.”

At the time thought he was completely nuts.

Later on put a years gross salary in the bank and stock market.

Learned to live below our income got savings then maxed out on 401k early in my career and in later years not so much and let effect of compounding build it up.

.

Had new hires at work who couldn’t explain difference of simple and compound interest, couldn’t balance their checkbooks and drove new fancy vehicles. It was all good until they got laid off for 5 months and fancy car got repossessed.

.

Sounds very much as if your retirement won’t be under those golden arches asking “ya want large fries?”

.

Happy to hear of a couple doing the right things to have a great retirement ! ! !

More likely due to luck than planning. Lots of people saw their 401Ks go down the toilet. People I’m talking about some of those are working 3 jobs and struggling to make ends meet. They aren’t driving a Rolls either. I think the economy would look better and those folks wouldn’t be so stressed if the US stayed out of foreign wars for to benefit the stockholders of the military industrial complex.

Capt

No luck involved as we have not touched our 401K except to ADD money to it with every pay check.

No luck involved as we chose to eat ramen, because that was what we could afford.

No luck involved because we took a vacation on Ocean Beach instead of Hawaii because that is what we could afford.

We live within our means, our paycheck. I think others need to stop attempting to buy new stuff to show up their neighbors. Others need to realize that quick rich scams are not worth the risks. Put your nose to the ground and let work. We plan to retire at 60 with zero debt and without social security benefits because we are not convinced it will still be funded.

But hey I appreciate you thinking I am just lucky ….

The problem with socialism – which is what we are moving towards – is that there is little incentive to work harder when you’re paying 50% to the government. Not to mention the required insurance and certification costs. Also considering that higher income means you are ineligible for free services and rebates.

Capitalism is the worse system except for all the others.

CA $20 minimum wage is designed to use employer’s money to get people off of welfare type services.

DEMs either didn’t care they’d be starting a wage price spiral or they absolutely don’t care who gets hurt as they get people off government dependency.

.

Same thing was done up in Washington state. Problem, as increased wages made workers ineligible for public aid the workers demanded reduced hours worked to retain benefits.

.

Largest problem with most DEM politicians, they’re prone to doing knee jerk quick fixes without consideration of human behavior or long term negative effects.

Legal Pot fiasco which increased law enforcement costs, gave street gangs an enhanced revenue source and made illegal pot grows extremely profitable.

Prop 47 created a huge property crime wave costing retailers many 100s of millions of dollars in losses.

.

Putting it simply most of what DEM politicians touch turns to excrement.

Who do you know is paying 50% of their earnings to the government. Your statement leaves me to believe you don’t understand how our tax brackets work.

Income tax + sales tax + property tax + excise gas taxes + tolls + auto registration + various licenses, bond measures, insurance requirements etc. etc. etc. = ~ 50%

50% may be a bit higher than actually being paid, but Yoyohop stated paying taxes to the government. I read that as not just federal income, but all other taxes as well. State income tax, SSN tax, Medicare tax, SDSI tax, property tax, auto licensing taxes, and throughout the year, state sales tax, the tax we pay just for fuel use (in CA, that is almost $1 per gallon), fees (Orwellian version of taxes) for utilities, crossing the bridges, and just about anything else all add up as well, and in my case, without adding the state sales/gas tax, I was at close to 40% (rough calculation).

Do you see how toilet paper is shrinking but costing the same or more. It does not matter now if you work hard or have a college degree. You can’t keep up. Young people should get into tech. That’s the only field that actually pays enough to live in this state.

The toilet paper situation alone is enough to make me get up, and go elsewhere.

Well Duh!

♥️

Has been said 70% of economy is from consumer spending.

Between congress and administration they’ve been dosing economy with cash.

Time will tell if Bernanke’s ideas will be proven right . . . . .

.

Takes roughly 10 quarters for government or FED monetary policy, to have an effect.

Consumer debt is already well past 2007 levels. What happens to the economy when credit cards are no longer an option for consumers and when there’s NO discretionary income to spend?

By time FED realizes what’s happening, it’ll already be too late.

CHum

I think it should be obvious that much of this stress was caused by the Covid pandemic. The US unemployemt rate was 14.7% in April 2020 in the final year of the Trump administration. The Bureau of Labor Statistics has reported an unemployment rate of 3.7% for January, 2024. The financial stress now being felt by many people should decline significantly as the year progresses.

%14 went to %3 percent because all the EDD claims ran out and they only count who is getting paid now,not how many are unemployed..sorry to burst your bubble,its all fake numbers,The claims started at %14 and slowly died.

Reality.Those that were denied,those whos claims ran out and those that never applied for EDD or cant,do not get counted.Youve been lied to all your life in Calif about unemployment.

If you don’t confuse materialism with self determination, you will be much better off.

Its called tightening the belt. But it needs to be done before the crisis hits.

The real problem is that people in this country are financially illiterate. They also have very little self control when it comes to spending. Combine these and you have a recipe for disaster. Just because you have checks in the book does not mean that you have money in the bank.

https://fablesofaesop.com/the-ant-and-the-grasshopper.html

Unfortunately, we are a country of grasshoppers relying on a few ants to carry the load. Take personal income taxes: the top 1% pay more than 50% of all taxes. Eventually there are too many grasshoppers and too few ants to support the system. We are getting close to that becoming reality.

Hmm, what will happen if top 1% who pay more than 50% of all taxes

simply decide to make less money ? ? ? ?

.

From 1979 and still true today !

https://www.youtube.com/watch?v=WTLwANVtnkA

Sorry OG, they already do that. Or spend all their profits. It’s a game. It would be helpful if the paid more. But it the government needs to SPEND less. That’s why we get bent on ukraine and immigration.

This is based on a false premise. Of course the top 1% pay nominally a large share of the overall taxes collected. On the other hand, as a share of income, they pay a very tiny amount, with many of them paying no taxes at all. An improved metaphor would be 99% of us flying into a big zapper with the bug zapper manufacturer running commercials about how they pay all the power bills.

Are you saying that the top 1% paying more of total taxes means that somehow the (shrinking) middle class isn’t working hard enough? I’m in my 40s and everyone I know is working 60 hour weeks for jobs that back-in-the-day would have given us pensions and paid us more than enough to live in a nice house in the hills and now we can’t even afford to live in an apartment anywhere “safe”. It’s mind-blowing how you think the 1% are somehow burdened and that my generation working twice as hard as our parents (and my parents agree with that statement, btw) is somehow us being lazy. Freaking BONKERS, my dude.

I think he’s saying you don’t work hard enough. Step it up will ya, you’re dragging us all down.

How’s China Joe’s’ Bidenomics working out for everyone?

Historically high inflation and fuel prices(just a couple of Joes monumental disasters) – China Joe and the democrats truly are the party of the American working class.

So it’s Joe’s fault that the CEO of Exxon and Shell needs 2 yachts instead of one?

Yes.

What a coincidence it is that gas prices skyrocketed the minute the China Joe took office.

Keep on parroting and supporting the mass media propaganda, CR.

I hope nobody is surprised at the politicians taking us down this path for the last 20 yrs… Calif and nation wide.

Poor liberals voting themselves and everyone else into oblivion

Y’all make it sound like this country owes you more than it’s given you. Maybe it does, maybe it doesn’t.

You know who has a bunch of money just sitting there, doing no one any good at all? Billionaires. And there’s more of them now than ever. And they’re laughing at us as we bicker over the crumbs.

Both political parties spend money like drunken frat boys with daddy’s credit card. And I can prove it.

This truly is a land of opportunity. Whining because you won’t do all that’s necessary to achieve upward mobility and blaming politicians is childish. Now if fate has handed you cards you just can’t play and bluffing isn’t an option, that I get. Whine away. For all the good it’ll do ya.

Hustle doesn’t beat talent, but it draws a tie often enough you should pay attention.

We were doomed the moment we let corporations not pay tax on their profits. It started a clock and that clock is winding down.

One good sized asteroid or the next pandemic, a really deadly one, makes it all irrelevant. 😝 Fingers crossed 🤞

Well somone has to pay for Newscums free programs. Hint, there not free you pay.

It has taken this long for people to realize that they will be held responsible for overextending themselves with credit (unless it is a forgiven student loan, then we tax payers remain on the hook), all the while seeing politicians like greasy gavvy, nutjob pelosi, barely there joe, also barely there mitch, bear no responsibility for the massive overspending leading to massive debt they have left for we tax payers. Some pigs are more equal than others.

The Newsom Syndicate missed its deficit estimates by $15 Billion dollars! They not only are incapable of managing our money, they are also incapable of forecasting. Perhaps this has to do with their failure to notice they continue to drive successful business out of California. Denial, Delusion, or both……..

Maxwell Smart used to say, “Missed it by that much”.

Newsom can claim, “Missed it by 20%”.

Gee, this won’t raise taxes will it?