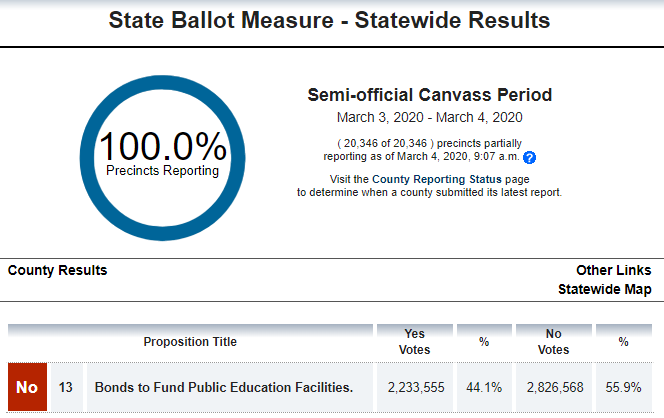

Prop.13, which would have authorized $15 billion in state general obligation bonds for construction and modernization of public education facilities, failed in California.

Opponents of the proposition say this measure authorizes $15 billion in borrowing, costing taxpayers $27 billion including interest, to build and repair schools. They said borrowing is nearly twice as expensive as paying for school construction from the regular budget, which has a $21 billion surplus.

Locally, in Contra Costa County, 89,000 voted “no”, and 79,000 voted “yes” for the statewide proposition.

62 comments

LOL.

GOOD.

Yes on NO. Too many bonds and taxes already. More to come in November.

Thank God people are gradually coming to their senses.

Good!

Sadly this tells us there are 79000 really gullible people in CCC.

That really is the frightening part.

Yup.

I was just thinking Ca voters were finally coming to their senses-but 79,000 people who aren’t is way too many.

Good. Very good. This one raised the limit on indebtedness that schools can take on, which means higher property taxes. Can we just stop with all of the tax increases? Maybe the state and other levels of government could hire some qualified financial types to analyze the budgets and point out where money is being wasted or spent fraudulently. Not that the politicians would care. They just love spending other people’s money, and unfortunately too many times people vote to give them more.

In addition to raising debt ceiling for districts that can’t handle current debt (Vallejo anyone?), Prop 13 (2020) was a Trojan horse. They claimed homeowners would be spared. BUT, the money raised would only be supplemental. This means school districts would need to float their own bonds district by district that would increase taxpayer burdens. This prop was complete smoke and mirrors.

Taxpayers should celebrate its defeat. But more is coming in November. The California Schools and Local Communities Funding Act is now circulating for placement on the November ballot. It is the same thing, protect homeowners from burdensome tax increases but turn around and ream taxpayers with local bond issues to get supplemental funding.

They’re running out of “other peoples money”…..thank God…it seems people in California are finally getting smart…has anyone been able to track where the gas tax money is going?

Ok. I don’t want to hear a SINGLE complaint about how our schools are failing, how bad traffic is, or how transportation in the Bay Area is horrible. Not. A. Peep.

The answer isn’t higher and higher and higher taxes. We have the highest gas taxes in the country. Our car fees are stupidly high. I have a 13 yr old car, and the fee actually went UP from last year and is close to $200. It’s a serious disincentive to buying a new car.

We have two bonds from the local school district on our tax bill already, along with two bonds from the community college district. Prop 13 would have meant more bonds piled on to those already existing. When is it enough?

What percentage of our income is acceptable to pay in total taxes? How big a bite does the government get, and keep coming back for more?

Because we do not approve the band-aid mechanism for funding these projects does not mean we want to settle for the circumstances we have currently with traffic and schools. If the NIMBYs hadn’t shot the Bay Area in the stomach to bleed out slowly, we’d be in a different spot. Stalling housing development in the Bay Area directly impacts school’s facilities budgets. Look at Pleasanton for example, wealthy alcove without money to fix their HS Gym floor because they have stalled any type of development for years.

Why? I’ve been around long enough to know that we have passed numerous measures and taxes over the years that were allegedly intended to deal with these problems. I think there is just cause to “peep”.

I reserve the right to peep all I want.

Our schools aren’t failing. The parents are. Personal responsibility.

You’re making the huge assumption that those propositions would have fixed the problems. I’m a fiscally conservative person, but I am definitely willing to spend on public works and schools. The problem is, people in this state have been shown time and time again that the money is siphoned off through waste and cronyism, and often very little is accomplished. I think things like high speed rail, finally pushed people over the edge.

PEEP!!!!!!!!!!!!!!!!!!!

I don’t have kids.

My commute is 5 minutes.

I hate jazz, man.

Until the politicians are held accountable for their financial mismanagement, every bond measure should be voted down. Every one of them..

It does no good to whine and cry about pothole, traffic, bad traffic, etc, etc, when the funds are NEVER spent as promised.

You can thank the crooks in Sacramento and the idiots who keep electing them to office.

we already are paying plenty if recently imposed taxes, registration fees, and tolls in various ways for everything on your list and nothing is getting done; mass transit meager and undependable. no more dumb financing.

Hope this shows to the people in Sacramento that the their piggy bank is closed and get the message that you need to stop pet projects and tell the truth, you need to put the taxes that come from gas taxes to use where they belong for the roads and bridges and stop diverting the money to pet projects

GOOD very good finally voters are waking up from this tax increase to use for NOTHING will not go to the school. it all LIES!!! Yep more to come in November and keep on voting NO on those tax crap.

The thing about this prop is that it would not have helped the schools. It would have caused more middle class citizens to lose their homes to excessive taxes. The prop would have eliminated the cap that was created for home owners back in the 1980s, If you pay 2000 a year in taxes, with this prop going through you would be paying upwards of 20,000 in taxes. The state and county would tax you according to what your home is worth now not what you bought it for.So if it is paid off, you would not be able to keep it because of the taxes levied against itl

79 000 people dumb enough to tax themselves again. So clueless, I can stand it.

They simply don’t pay any taxes. Those with a stake in the game are the only ones that should have voting rights.

Renters are indirectly effected by these tax measures levied on property owners as well, although they may not realize it. When a landlord’s property tax goes up, they are forced to raise rents. If you don’t want your rent to increase, don’t vote to approve every bond measure that comes along.

Delighted that so many people saw right through this pathetic attempt to fool the public into spending 27 billion to borrow15 billion. This was heavily backed by developers because it reduced and in some cases eliminated developer fees to support local schools. Thank you to everyone who voted against it, but look for another attempt in November.

Those who did vote yes are probably either apartment dwellers / renters or younger people who still live at home and have no responsibilities to paying the property taxes. Thing is, if it did pass, their rent would be increased so the property owners can pay the increased taxes. Vote down all proposals to increase any taxes in California, we pay enough of them already.

I find your comment a little bit rude. I am young and I don’t pay rent because I live at home and go to school part time. I still voted no on this and every single one of my friends did as well.

My job is in San Rafael and the congestion over that bridge is bad enough to make me leave an hour earlier than I should for work and still I voted no.

We “young people” are not as stupid as you make us out to be. Maybe you shouldn’t assume anything. Assuming things is a very dangerous trait. It has caused everything between wars and divorces. Be more mindful of yourself and what you write.

Tango didn’t say all young people voted yes.

Schools should be setting aside money for maintenance. It would be nice to see how much the bond underwriters receive and spend on lobbying. California is big enough to pay as we go vs. borrowing.

Wow 79,000 voters that still dont’ get it.

Thank you ..to everyone that voted…NO

Good! Too close for comfort if you ask me, though.

Website Ballotpedia compiles data in one spot.

A good site to add to bookmarks if you’d like to be an informed voter.

What is interesting, besides the Total raised: $9,669,417.16

Total spent: $6,565,709.85 by those in favor of the Prop.

It evidently also included raising of debt ceiling local districts could have.

Take a look at Media editorials section of webpage below.

https://ballotpedia.org/California_Proposition_13,_School_and_College_Facilities_Bond_(March_2020)

One might hope liberal politicians would get the message.

Rest assured they will delude themselves by lamenting not spending enough to influence voters. . . . . .

Don’t ask for a tax increase in the month that I prepared my tax return. I hate more tax!

The STATE could have used funds from their surplus to pay for school remodeling.

Prop. 13 was a $15 Billion Dollar bond that got repaid over 35 years with interest ($11 Billion) totaling $26 BILLION.

A poorly, ill-conceived proposition!

Why do all the conservatives call for spending the surplus set up by Gov Brown as a rainy day fund for an economic downturn?

It appears the way thing are going we’re going to need it for just that an economic downturn.

No need for a rainy day fund as Ozzie explains it- the purpose for the fund is to pay the unfunded retirement benefits due state employees after they retire. It’s the single largest unfunded liability the state has.

It has absolutely nothing to do with a “rainy day”. 22 Billion dollars and counting.

SEIU and AFSCME carved out the deal with sympathetic Democrat legislature.

And the beat goes on….

The state could use the money they get from the lottery to pay for school remodeling. That is why they started the state lottery to begin with. To take the burden of public school funding away from them. How soon people forget stuff like this when it is not for them directly.

Schools are supposed to funded by property taxes. Where is all the property tax money going we all currently pay? We will probably never know, because there is zero accountability for the government that is spending our proper tax dollars.

YAY! Finally people are waking up. Both 13 and J going down made my day. The hogs had to figure sooner or later the trough would run dry. Great to see it finally happened

They must be really scrambling up there in Sacramento. “They are getting wise to us, we have to protect our phony-baloney jobs”. “Hey, I didn’t get a harumpf out of that guy”. “Give the Governor a harumpf”.

Oh wait, that was Blazing Saddles……

Here is the multibillion dollar question. Whatever happened to the third of the lottery sales going to the schools? One of the largest pitches for the lottery was money going to schools. The lottery has been in place decades and still our schools are in need of money.

Yes. That was the one saving grace that sold the California Lottery to the masses. Then we never heard another word about it.

The money still goes to the schools. But, much like caltrans, bart, city and county governments, the funds are mismanaged. They go to spiked employee pensions and paying off lawsuits.

The proceeds are held in trust until somebody you can trust can collect.

There is a vast shortage of individuals that are both eligible and trustworthy.

A recent audit found the lottery owed the schools 36 million dollars.

@burnbabyburn – actually, less then 1 percent of the lottery goes to fund the schools in CA. The rest is mismanaged by our state dept. Billions go to people in winnings, then the rest goes to line the pockets of the political peeps. How do you think a Gov who was worth 250,000 a year is now worth more than 500 million. Just in the time he has been in office. Keep looking the other way you libs. This is the result.

Screw you newsom. And warren lost big so the same to your wife.

This is only round 1. They are coming back again in November. Someone tried to get me to sign a petition for the “better prop 13.” No thank you.

Close the schools, the Libraries are already used for babysitting in the afternoon…If the kids need an education reinstitute the Military Draft!

How our schools receive money is outdated.

Can someone please tell me where in the ballot did it say property tax would be raised? Where does it say any taxes would be raised? It literally says the money would be taking from the California general fund, ya know… One that California has either way… Now the stupid part is that money is going to go to something else and not to better our schools..

It’s hilarious seeing comments saying “79,000 people are stupid” when the rest of you idiots just said no to making schools better for your kids lololol from money that was ALREADY there.

@JackFlash

Read the original prop13. Then read the prop 13 retraction on the ballot this year.

@JackFlash,

For some reason, you have confused Prop. 13 the Jarvis-Gann initiative from 1978 with the School Bond Proposition that was on the ballot earlier this week, which had absolutely NOTHING to do with raising property taxes.

The money is being raised via a Bond issue. Paying off the Bonds would be done over the course of 35 years at an interest expense of $11 Billion, bringing the total tab to $26 Billion.

It’s a General Obligation Bond which will be repaid out of the state’s general fund. Nothing unusual about that.

In order for local school districts to be eligible for the State Bond money, the local districts must pass local school bonds in order to generate the MATCHING funds required. (this is very similar to Measure J, the County Transportation measure).

This is where there is a risk to property owners that their property tax will go up, given that local bonds usually come with a tax hike.

Unfortunately, this Prop. 13 would also allow the school district’s to double their debt cap. School districts currently have a debt cap based on the total assessed value of taxable property in their district. Nearly doubling the debt cap would allow school districts to sell more Bonds.

Like I said previously, this was a poor and very ill-conceived path to modernizing schools.

The Original Prop 13 protected property owners from excessive yearly raises of property taxes by limiting it, in most cases, to no more than 2% of assessed property value. That property value was rstablished as the property value as of 1978. The New Prop 13 got around this limit, as many municipalities have done, by passing their own Special Assessments allowing school districts to pass larger bonds at rates as high as 4% of assessed property value. This guaranteed excessive increases in property taxes. The Howard Jarvis website has been warning about this for years. Rather than tightening their belt, local municipalities are getting their funding by financing everything by these more unregulated Special Assessments. Their website is a wealth of information on tax issues.

https://www.hjta.org/

I bet those 79,000 people are not property owners…

Maybe the 79,000 aren’t property owners, but higher property taxes translates to higher rent when landlords must raise the rent or suffer the loss in their bottom line.

It’s much closer than I thought it would be. I honestly don’t know of the long-term impact had it passed. All I know is that if Prop 13 ever gets repealed in some way I would no longer be able to afford my home. Write a new proposition but don’t F with Prop 13.

Proposition 13 and measure J have been voted down by well informed voters. How gratifying that their incessant tax measures will not reward them for once and we get to keep a bit more of our money. And don’t fret, that we took revenue from schools or roads as they have already conveyed. But alas, don’t think that for one minute that they and their constituents are not already working on the next tax measures to line their wallets and or political aspirations……

people are finally figuring out we never get what is promised with these measures; then they just ask for more and more money….

Comments are closed.